voluntary life and ad&d child

It usually costs about 5 per year for every 1000 worth of. What Employees Get With Accidental Death Dismemberment Insurance.

Apply Online and Save 70.

. The Spouse Life cost is based on your spouses age and the amount of coverage. 16 rows Dependent coverage is contingent on you having Voluntary Life and ADD coverage. Voluntary Life and ADD.

You pay the full cost. While Basic Life and ADD typically only covers employees organizations can offer Voluntary Life and ADD coverage for spouses and dependent children. Accidental death and dismemberment coverage for employees only is included in the UNC Voluntary Life Insurance Plan at no additional cost.

Ability Assist Provides confidential support for emotional legal and financial issues. A child rider is more affordable than a full child life insurance policy. Percentage of your Voluntary ADD insurance as follows.

10000 for each child age 6 months to 26 years. Voluntary accidental death and dismemberment insurance or voluntary ad d insurance is often offered by employers similar to voluntary life insurance. Ad 2022s Top Life Insurance Providers.

Dependent coverage is a percentage of the employees elected amount with a 25000 maximum per child. Voluntary life insurance and accidental death and dismemberment ADD policies are offered to employees as part of a companys benefits plan and you can typically purchase coverage for yourself your spouse or your children. HealthChampion SM Offers unlimited access to.

They provide you with the ability to make sure that your family will be financially secure if you happen to pass away. What is voluntary Child life and ADD. Voluntary Supplemental Life Insurance allows you to purchase additional life insurance to protect your familys financial security.

The EmployeeFamily option cost is 032 cents per 1000 of coverage. Reviews Trusted by 45000000. Voluntary Supplemental Life and ADD Insurance.

Browse Several Top Life Insurance Providers At Once. A child rider provides a death benefit if any of your children pass away without the complex investing component and can be converted to a permanent policy in the future if your child needs lifelong coverage. You may enroll at any time no health questions asked.

YOU MUST ENROLL FOR EMPLOYEE SUPPLEMENTAL LIFE TO ENROLL FOR SPOUSE ANDOR CHILD LIFE. You pay the full cost of this coverage on an after-tax basis. Spouseregistered domestic partner and dependent children coverage is also available.

This is an employee paid benefit. Amounts over the GI and subsequent elections may require EOI. Eligible County employees in all bargaining units have the option to purchase additional life insurance for themselves their spouse or their dependent children.

The premium amount will be automatically deducted from your paycheck. The Voluntary Life and ADD Insurance is convertible or portable for eligible individuals. Provides a benefit in the event of death or dismemberment as a result of a covered accident.

If you elect Voluntary Life Insurance for yourself you may buy Life Insurance coverage for your spouse or eligible children. To purchase voluntary life and ADD you must enroll within 31 days of your hire date. As with any type of life insurance plan voluntary life and ADD is a financial tool that provides a sum of money to your beneficiary upon your death.

Ad The Comfort of a Reliable Life Insurance is Priceless. Voluntary child add insurance. Voluntary group accidental death and dismemberment ADD insurance is a simple way for employees to supplement their life insurance coverage with additional protection if they or a family member dies or is dismembered as a result of a covered accident.

Short Term Disability Insurance Short Term Disability STD provides paycheck protection for employees. SpouseDomestic Partner only 60 percent of your coverage Children only 15 percent of your coverage for each child. Voluntary Group ADD Insurance.

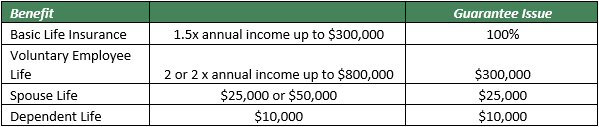

Disabled children may be eligible for the 10000 benefit past the age of 26. The employee must be approved for coverage to add dependents. As a new hire employee you may elect up to the Guarantee Issue GI amounts noted below without Evidence of Insurability EOI.

A request to increase the voluntary ADD only requires a Benefit EnrollmentWaiver Form. We go beyond the benefit with a variety of value-added employee services to help make the difficult times a little bit easier. The Child Life rate is a flat amount regardless of the number of children covered.

Get Instantly Matched with Your Ideal Life Insurance Plan. Ad A Policy Will Protect Provide For Your Loved Ones When You No Longer Can. The total cost is 021 cents per 1000 of coverage for Employee Only option.

Coverage is available for your spouse andor children if you purchase coverage for yourself. Find The Right Plan For You.

Voluntary Life Insurance The Hartford

Underwritten By Minnesota Life Insurance Company Group Term Life And Ad D Insurance The Texas A M University System Ppt Download

Voluntary Life Insurance The Hartford

Voluntary Life Insurance The Hartford

Voluntary Life Insurance The Hartford

Child Life Insurance What Is It And Should You Buy It Nerdwallet

Mental Health Support Ensign Benefits

Underwritten By Minnesota Life Insurance Company Group Term Life And Ad D Insurance The Texas A M University System Ppt Download

What Is Voluntary Ad D Accidental Death Dismemberment

Voluntary Benefits Mychattbenefits

Life Insurance South Georgia Medical Center

What Is Voluntary Ad D Accidental Death Dismemberment

/GettyImages-1143762481-92466e5f4b614a6a8b466fb0993af6d2.jpg)